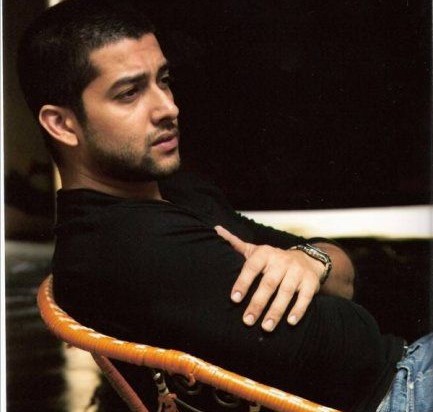

Notable Bollywood Actor Aftab Shivdasani Recently Targeted by Cyber Fraud, Suffering a Loss of Rs 1.50 Lakh via a Text Message KYC Scam

In a recent cyber fraud incident, Bollywood actor Aftab Shivdasani fell prey to scammers, resulting in a loss of Rs 1.50 lakh. The actor received a text message prompting him to update his Know Your Customer (KYC) details through a link provided in the message. Unbeknownst to him, the link was a phishing attempt, leading to the unauthorized withdrawal of funds from his bank account. According to PTI, the incident unfolded on a Sunday when Aftab Shivdasani received a KYC update message from an unfamiliar number. The message warned him that failing to comply would result in the suspension of his account. He followed the instructions by clicking on the link, only to receive a subsequent message informing him of a Rs 1,49,999 debit from his account, which he later included in his police complaint.

Realizing he had been deceived, the actor promptly contacted the bank’s branch manager on Monday and filed a formal police complaint. Subsequently, a case was registered under sections of the Indian Penal Code (IPC), particularly Section 420 (cheating), along with provisions from the Information Technology (IT) Act. Ongoing investigations are in progress.

Escalating KYC Scams in India

While online scams are a prevalent concern throughout the nation, it is disconcerting to observe the emergence of hotspots for these activities in cities like Mumbai, Bengaluru, and Pune. A recent report from the Union Finance Ministry disclosed that cyber cells in Mumbai alone recorded over 95,000 fraud cases related to UPI transactions between 2022 and 2023. Notably, scammers managed to siphon off Rs 1 crore from 81 victims through KYC scams in Mumbai.

How to Safeguard Yourself

To protect against online scams, especially KYC-related ones, vigilance and proactive measures are crucial. Here are some key tips to ensure your safety:

- Verify the Source: Always verify the sender’s identity. If you receive a message or email requesting personal or financial information, confirm its authenticity with the relevant institution or individual through their official channels.

- Avoid Clicking Suspicious Links: Refrain from clicking on links in unsolicited messages. Instead, manually enter the official website’s URL into your browser or use a reputable search engine to locate it.

- Beware of Urgent Requests: Scammers often induce a sense of urgency to pressure individuals into making hasty decisions. Take your time to verify any request.

- Protect Personal Information: Never divulge sensitive information, such as your Social Security number, bank account details, or personal identification documents, through unverified channels.

- Use Official Apps: Download and employ official apps for banking, transactions, and KYC updates exclusively from trusted sources like app stores.

Remember, financial institutions and other reputable companies do not solicit personal information online. Should you receive such requests, exercise caution, as you may be the target of a scam